Reliance Nippon Life Asset Management Rs 1500 Crore IPO to hit market on October 25

BFSI Industry

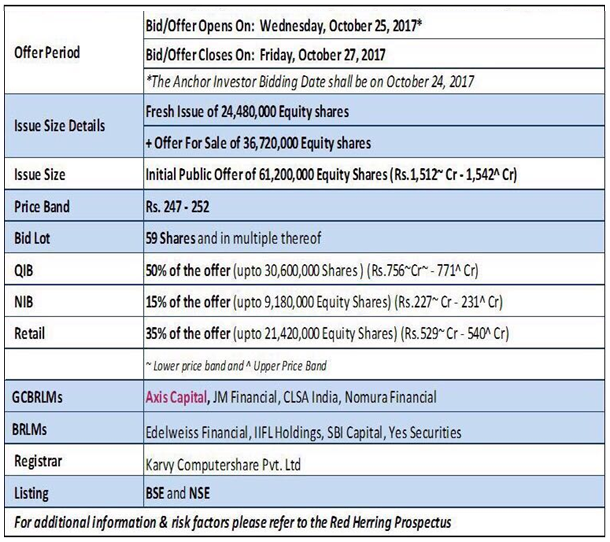

Summary of the IPO

Reliance Nippon is one of the largest asset management companies in India. Despite increase in the number of players, the Indian mutual fund industry is largely remained concentrated with the top 10 largest AMC’s accounting for more than 80% of the industry’s total AUM between FY15 and FY17.

With increasing household savings and financial awareness among the investing population of India, there is gradual shift from physical saving to financial saving. Further, with demonetization, RERA implementation, and GST roll-out, value of real estate and gold as an investment option has reduced. Given the under-penetrated nature of MF industry coupled with first-mover advantage followed by well-diversified suite of products and multi-channel distribution network, we believe the company is set to benefit in the long run.

At Upper price band of Rs 252/-, company trades at 7.8x its FY17 P/B Value of Rs 32.2, which is fairly priced. Hence SUBSCRIBE TO THE ISSUE can be recommended on long term basis.

To invest in the IPO please click on the below links –

The Anil Ambani-led Reliance Group firm Reliance Nippon Life Asset Management Ltd.’s Rs 1,542 Crore initial public offer (IPO) will open for subscription on October 25, 2017. This would be the first ever IPO by an Asset Management Company (AMC) in India. Company’s CEO Mr. Sundeep Sikka had said the company initially aims to dilute 10% stake and further 15% as per the SEBI norms. Reliance Nippon Life Asset Management got the Board of Director’s nod in June to launch the IPO.

Jointly owned by Japan’s Nippon Life and Reliance Capital, the firm is the asset manager to Reliance Mutual Fund.

The issue, with a marquee price band of Rs 247-252 per equity share, will open on 25th and close on October 27, 2017. The offer by the manager of India’s third-biggest mutual fund by assets under management involves a 10 percent stake sale in the company.

The public issue would comprise of fresh issuance of 2.45 Crore shares, besides an offer for sale (OFS) of 1.12 Crore shares by Reliance Capital and 2.55 Crore shares by Nippon Life Insurance Company. The IPO size would be around 10 per cent of the post issue paid-up capital of the company.

Reliance Nippon Life Asset Management is the largest asset management company in India and has around Rs 359,000 Crores assets under management, including Rs 2.23 lakh Crores for mutual funds. “The idea is to be in a state of readiness for both growth opportunities that lie ahead and even more for the consolidation that will happen,” according to CEO Mr. Sundeep Sikka. According to him “the proceeds will be used for both organic and inorganic opportunities and growth for this company.”

The company has pan-India network of 171 branches, of which 132 were in B-15 cities, as of June 30. It intends to increase its branch network by adding 150 new branches and relocating 54 exiting branches in the B-15 locations by March 31, 2021.

The Reliance Capital-promoted company saw its revenues and profit after tax (PAT) rising at compound annual growth rates of 18.2 per cent and 15 per cent, respectively, over FY 13-17.

The Securities and Exchange Board of India (SEBI) issued its observations on the proposed IPO of Reliance Nippon on October 5, as per the latest update available on the regulator’s website.

As of June 2017, there are 41 active AMCs actively operating in the current market comprising of 7 entities sponsored by public sector banks, 2 entities sponsored by financial institutions, 25 AMCs sponsored by the private sector and other financial companies and 7 entities sponsored by foreign players (including joint ventures).

JM Financial, CLSA, Nomura and Axis Capital are the main banks managing the IPO while Edelweiss, IIFL Holdings, SBI Capital Markets and Yes Securities as book-runners.

Why Reliance Nippon Life Asset Management IPO looks attractive

- India’s Mutual Fund Industry double over the last 3 years with prospect of further spectacular growth from here

- Reliance Nippon Life Asset Management is the 3rd largest AMC in India and the most profitable. It is also the first AMC to come with an IPO

- Reliance Nippon Life Asset Management has a history of 22 years of stellar performance. The AMC has double the customer folios in the last 10 years and multiplied the AUM by 4 folds in the same period

- The funds from the IPO will be used for Branch expansion, enhancing the IT capabilities, Sales & Marketing and also for acquisitions which can lead to disproportionate growth.

- Nippon Life has 125 years of successful operating experience and at UD$ 577 billion, its asset size is almost double that of the entire mutual fund industry size in India.

Therefore we believe this is the right opportunity for you to invest in the IPO for the long term.

Happy Investing!

Invest Now:

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Suren Kochhar joins Advisorkhoj

May 12, 2023

-

Network FP raises capital through crowd funding from financial advisors and distributors

Feb 9, 2022

-

Sundaram Mutual launches WhatsApp Services

Mar 3, 2021

-

Sundaram Mutual celebrates Silver Jubilee today

Feb 26, 2021

-

ICICI Pru AMC announces appointment of Anand Shah as Head PMS and AIF Investments

Feb 9, 2021